Whether you’re a financial advisor, investment issuer, or other monetary Expert, examine how SDIRAs can become a powerful asset to develop your organization and obtain your Skilled goals.

Bigger Expenses: SDIRAs typically include larger administrative charges when compared with other IRAs, as particular components of the executive process cannot be automated.

In case you’re hunting for a ‘set and neglect’ investing approach, an SDIRA most likely isn’t the right option. Simply because you are in total Handle above just about every investment made, It truly is up to you to perform your own homework. Don't forget, SDIRA custodians are not fiduciaries and can't make tips about investments.

The tax rewards are what make SDIRAs attractive For most. An SDIRA might be equally regular or Roth - the account form you choose will rely mainly on your own investment and tax method. Check with the economic advisor or tax advisor in the event you’re Doubtful which is greatest to suit your needs.

Criminals in some cases prey on SDIRA holders; encouraging them to open accounts for the purpose of generating fraudulent investments. They normally idiot buyers by telling them that if the investment is accepted by a self-directed IRA custodian, it must be legitimate, which isn’t true. Yet again, make sure to do complete due diligence on all investments you decide on.

Ease of Use and Technological know-how: A user-pleasant platform with on-line instruments to track your investments, submit documents, and take care of your account is vital.

Adding cash on to your account. Remember that contributions are subject matter to once-a-year IRA contribution restrictions established from the IRS.

Have the liberty to speculate in Virtually any type of asset with a possibility profile that fits your investment strategy; such as assets that have the probable for a greater level of return.

Choice of Investment Possibilities: Make sure the supplier enables the types of alternative investments you’re enthusiastic about, including real estate, precious metals, or personal equity.

And since some SDIRAs such as self-directed conventional IRAs are subject matter to essential minimum amount distributions (RMDs), you’ll must strategy in advance in order that you've sufficient liquidity to meet the rules established from the IRS.

Making probably the most of tax-advantaged accounts lets you maintain much more of the money that you choose to commit and gain. According to whether or not you end up picking a conventional self-directed IRA or perhaps a self-directed Roth Read More Here IRA, you might have the opportunity for tax-cost-free or tax-deferred growth, delivered particular problems are fulfilled.

Place basically, in the event you’re seeking discover here a tax economical way to make a portfolio that’s far more personalized in your passions and know-how, an SDIRA may be The solution.

Therefore, they have an inclination not to promote self-directed IRAs, which offer the pliability to invest within a broader number of assets.

An SDIRA custodian differs because they have the appropriate team, know-how, and potential to take care of custody click for source of your alternative investments. The initial step in opening a self-directed IRA is to locate a supplier which is specialised in administering accounts for alternative investments.

The most crucial SDIRA rules from your IRS that investors have to have to grasp are investment limits, disqualified persons, and prohibited transactions. Account holders ought to abide by SDIRA rules and restrictions in order to preserve the tax-advantaged standing in their account.

Complexity and Duty: By having an SDIRA, you have much more Management about your investments, but you also bear much more duty.

Contrary to shares and bonds, alternative assets will often be more difficult to offer or can come with stringent contracts and schedules.

Being an Trader, on the other hand, your options are not limited to shares and bonds if you decide on to self-immediate your retirement accounts. That’s why an SDIRA can renovate your portfolio.

Often, the service fees linked to SDIRAs is usually increased and a lot more difficult than with a daily IRA. This is due to of your greater complexity connected to administering the account.

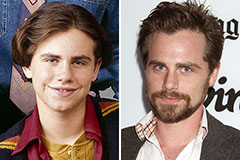

Rider Strong Then & Now!

Rider Strong Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Val Kilmer Then & Now!

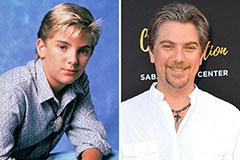

Val Kilmer Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!